Did you know that Federal Law requires the submission of a Beneficial Ownership Information Report (BOI) to the Financial Crimes Enforcement Network (FinCEN) for all businesses? This requirement rolling out in 2024 is part of the Corporate Transparency Act (CTA), aimed at combating illicit financial activities.

Who is required to report?

The CTA casts a wide net, applying to both new and existing businesses in the United States, including limited liability companies (LLCs), corporations, limited liability partnerships (LLPs), professional corporations (PCs), and professional limited liability companies (PLLCs). If your business fits this description, you’ll need to file a beneficial ownership report as failure to comply with the CTA can be a criminal act or result in a civil penalty.

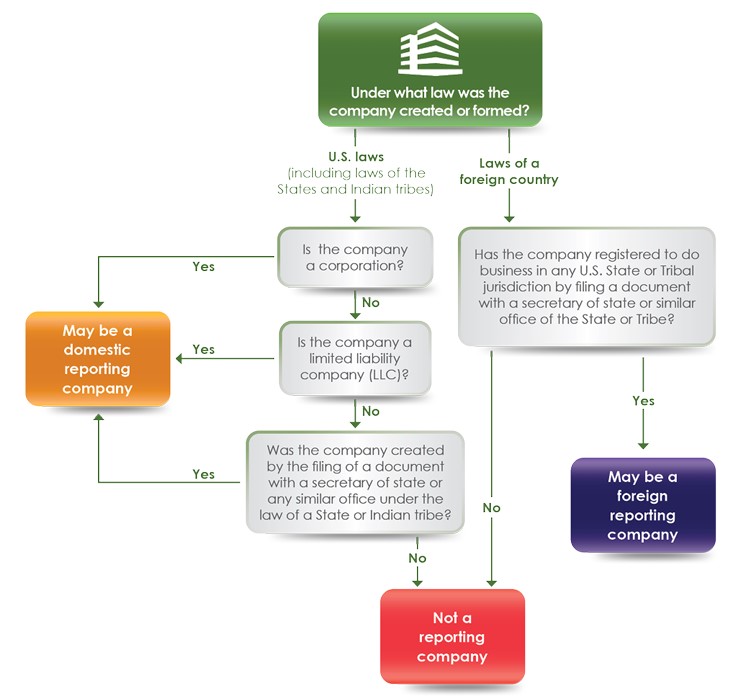

FinCEN rules require all “Reporting Companies” to comply with these requirements and report their beneficial ownership information. A Reporting Company can be either a US domestic or foreign company, and may be required to comply depending on what laws formed the company and if it does business in the United States. See the chart below for a clear definition:

Source: Small Entity Compliance Guide, FinCEN, Version 1.1, December 2023

Who is a Beneficial Owner?

A beneficial owner is someone with significant control or ownership (25% or more) in your company. This includes:

- Those who hold at least 25% ownership or control

- Senior officers like CEOs, presidents, or general counsels who exercise substantial control.

- Individuals who make crucial decisions regarding the company’s business, finances, or structure.

When filing, you’ll need to give FinCEN some details about your company and its beneficial owners, including:

Reporting Company Information

- Full Legal Name: Your company’s official name, just like it’s registered with the state

- Trade or DBA Names: Any other names your company uses to do business

- Address: Your company’s physical address, where you hang your hat

- Federal Taxpayer Identification Number: Your company’s tax ID number, for tax purposes

- Jurisdiction: The state or country where your company was formed, its birthplace

In addition to your company’s info, you’ll need to provide details about the people who own or control it.

Beneficial Ownership Information

For each beneficial owner, you’ll need to provide:

- Full Legal Name: Their official name, no nicknames or aliases

- Date of Birth: Their birthdate, to help identify them

- Current Street Address: Their current address, where they reside

- Unique Identifying Number and Issuing Jurisdiction: i.e. a driver’s license or passport number, and the state or country that issued it

- Image of Acceptable Identification Document: A copy of their ID document, to verify their identity

Ongoing Reporting Requirements

If anything changes, you must update your report within 30 days. This includes:

Inaccurate Information:

- Fixing any mistakes in your previous report

- Departure or Arrival of New Beneficial Owners: Adding or removing owners, or changes to their roles

- Changes to Beneficial Ownership Reporting: Updating an owner’s information, like their name or address

- Addition or Removal of Beneficial Owners: Changes to your company’s ownership structure

- Minor Status: When a minor owner turns 18, you’ll need to update their status

- Estate Settlement: If an owner passes away, you’ll need to report any changes within 30 days of their estate being settled

Filing Deadlines

- Entities formed before January 1, 2024, must file by January 1, 2025

- Entities formed between January 1, 2024, and January 1, 2025, must file within 90 days of formation or public announcement

- Entities formed on or after January 1, 2025, must file within 30 days of formation or public announcement

- Updates to previously filed information must be submitted within 30 days

Under the Corporate Transparency Act, failure to file this report accurately and on time may result in civil and criminal penalties, including fines of up to $500 per day past the deadline and up to 2 years of imprisonment.

Don’t let non-compliance put your business at risk. We can help ensure you meet the deadline and avoid costly penalties. Contact us today to schedule a consultation and let us guide you through the Corporate Transparency Act’s requirements.

For additional information on corporate transparency reporting, visit fincen.gov/boi.

Leave a Reply